What Happens If 1031 Exchange Falls Through?

What Happens If 1031 Exchange Falls Through

What to Expect if Your 1031 Exchange Falls Through?

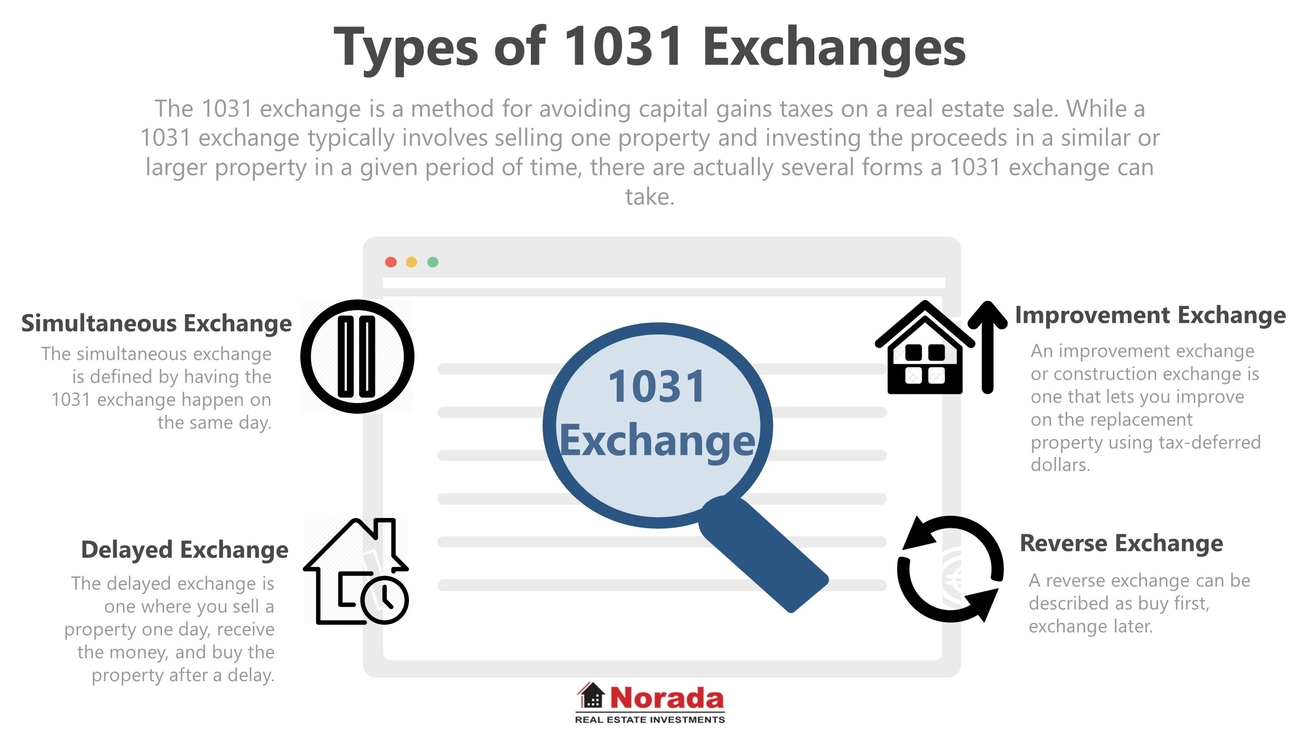

A 1031 exchange allows investors to defer taxes when they are looking to sell real estate for investment and reinvest the proceeds in another property. But what if a 1031 exchange falls through? While it is not always an ideal scenario, the risks involved with a 1031 exchange can be managed and mitigated if it fails. Here, we will discuss what to expect if your 1031 Exchange falls through and what steps to take to protect your investment.

Potential Reasons Why a 1031 Exchange May Fail

A 1031 Exchange may fall through for a few potential reasons. These include:

- The investor couldn't find a suitable replacement property in the specified time frame

- The investor did not meet certain conditions of the exchange, such as the 1031 exchange timeline or the "like-kind" requirement

- The investor failed to identify potential properties within the 45-day time frame

It is also possible that the investor misread the rules concerning capital gains and failed to accurately interpret the Internal Revenue Code. Regardless of the reasons, when a 1031 exchange fails, the investor can face some harsh financial consequences.

Financial Consequences of a Failed 1031 Exchange

The financial consequences of a failed 1031 exchange may vary depending on the situation. Generally speaking, the investor must pay capital gains taxes on the profits from the original investment property, as well as any taxes on depreciation that may have been taken. In some cases, the investor may also be subject to interest and late payment penalties if the taxes are not paid in a timely manner.

Additionally, it is important to keep in mind the potential risks and impacts upon the investor credit. A failed 1031 exchange may go against them when applying for future loans or credit since the unpaid taxes and late payments may be reported to credit agencies.

Reverse 1031 Exchange

If you find yourself in a situation where you need to liquidate a property but may not qualify for a 1031 exchange, there is an option called a Reverse 1031 Exchange. This type of exchange works in a manner that is similar to a traditional 1031 exchange, but instead of selling a property and then buying a replacement property, you purchase a replacement property and then sell the original property. As with a traditional 1031 exchange, the profits generated by the sale of the original property can be sheltered from capital gains taxes.

Since reverse 1031 exchanges require the sale to happen after the purchase, it is important to have a plan in place to ensure that you have the funds to purchase the replacement property. Additionally, there are some additional steps that must be taken when completing a reverse 1031 exchange, such as setting up an Exchange Accommodation Titleholder (EAT) to act as the buyer and seller in the transaction.

1031 Exchange Alternatives

If a 1031 exchange or reverse 1031 exchange is not an option, there are other alternatives to consider. For instance, a 1031 exchange alternative such as an installment sale allows investors to sell their existing property in exchange for installment payments over a period of time, while deferring the capital gains taxes on the profits. This option can be beneficial for investors who need to liquidate an asset in order to fund a financial obligation or to pay off debts.

Other alternatives include exchanging into real estate investment trusts (REITs) or taking advantage of passive investment strategies such as a rental property or a vacation home. Each of these options offers investors the opportunity to defer capital gains taxes on the profits associated with the sale of their existing property.

Investment Guidance Can Help Mitigate Risk

When contemplating a 1031 exchange or other real estate investment strategies, it is important to understand the associated regulations and requirements. Working with a qualified and knowledgeable advisor can help investors to navigate the complexities and reduce the risks associated with the process. Experienced advisors can provide guidance on the best strategies to meet an investor's needs, as well as help to ensure that completion requirements are met.

By understanding the risks associated with a 1031 exchange and knowing what to expect if the process falls through, investors can better manage their real estate investments and protect their financial future.

Post a Comment for "What Happens If 1031 Exchange Falls Through?"